The Data Is In: Property Tax Appeals Are Easier Than You Think. Here is the data

Real data from San Mateo County proves the process works: 98% of completed appeals get reductions, negotiations beat litigation, and comparable sales are all you need to claim $2K+/year in savings

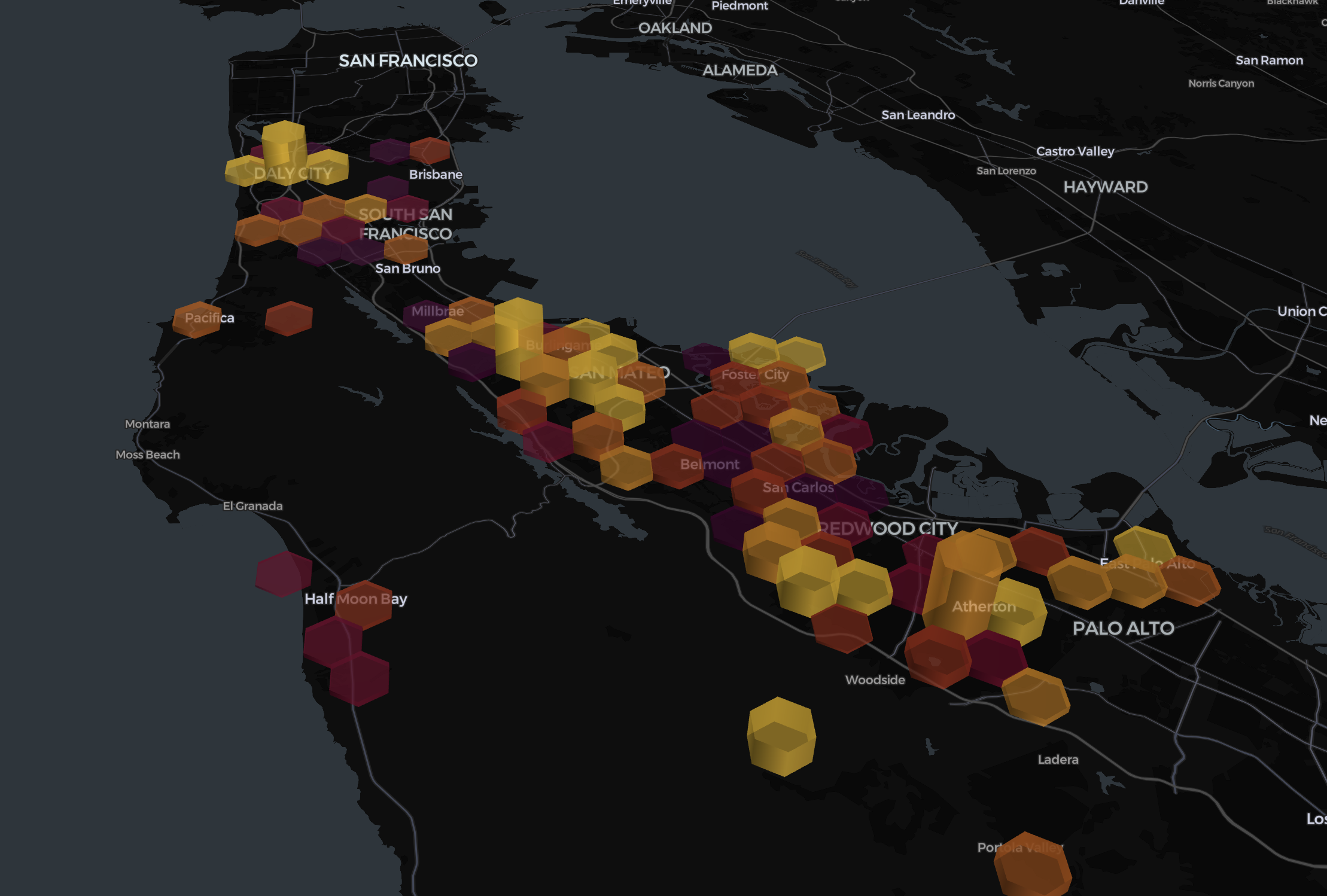

Visualization of successful property tax appeals in San Mateo County for 2023. Bar height represents absolute refund amount by location.

Visualization of successful property tax appeals in San Mateo County for 2023. Bar height represents absolute refund amount by location.

Part 1: The Surprising Reality of Property Tax Appeals in California

If you're a California homeowner contemplating a property tax appeal, you've probably heard conflicting advice: "It's totally worth it!" versus "Don't bother, you'll never win." The truth, as revealed by analyzing 1,651 actual appeals from San Mateo County in 2023, is far more nuanced—and surprisingly encouraging.

While this analysis focuses on San Mateo County—one of California's largest and most active property tax appeal jurisdictions—the patterns we observe likely reflect broader trends across California's county-administered appeals system.

The Big Picture: What Actually Happens

Here's the most surprising finding from analyzing 1,651 property tax appeals: 97% of successful cases never went to a formal hearing. They settled through negotiation.

But let's start with what actually happened to these 1,651 appeals filed in San Mateo County in 2023:

- 37% got decided with a final outcome about an assessed value reduction

- 42% were withdrawn by the property owner before completion

- 18% were still pending (the county hadn't finished processing these yet)

- 3% resulted in non-appearance or other administrative closures

The 18% "still pending" reflects the county's backlog at the time of our analysis. For completed appeals, here's what the data reveals about who actually got their home's assessed value reduced...

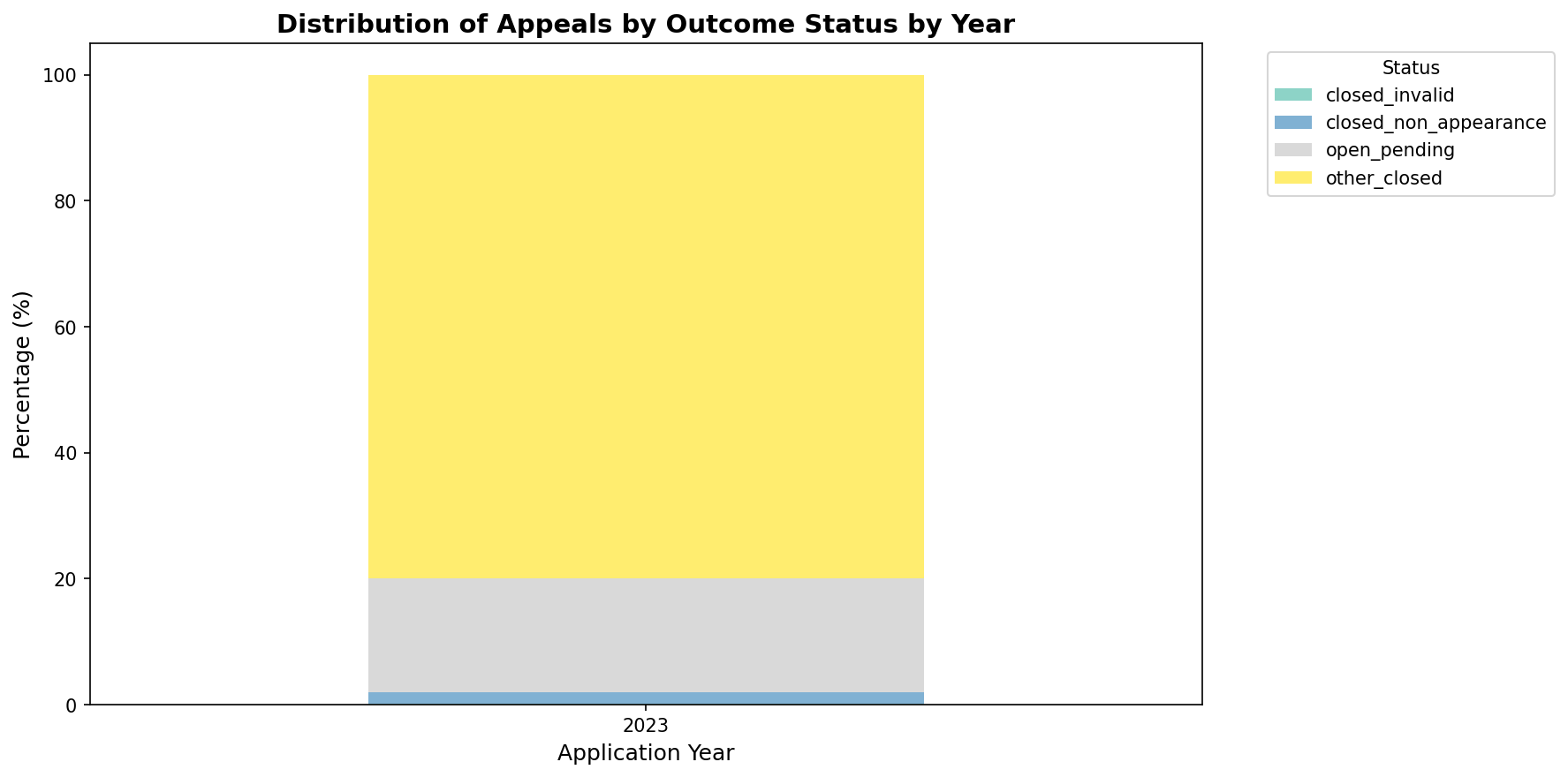

Visual breakdown of appeal outcomes: The majority (~80%) close without formal decision (yellow), while ~20% remain pending (gray) and only a small portion result in non-appearance (blue).

Visual breakdown of appeal outcomes: The majority (~80%) close without formal decision (yellow), while ~20% remain pending (gray) and only a small portion result in non-appearance (blue).

The Withdrawal Reality

The single largest category in the entire dataset is "Closed-Withdrawn" at 692 cases—that's 41.9% of all appeals. This is actually larger than all decided cases combined (618 cases).

Why do so many property owners withdraw their appeals? We don't have data on the specific reasons, but the most likely scenarios are:

- The home was sold - Property changed hands before the appeal concluded

- People moved on - Homeowners gave up or lost interest in pursuing the case

Here's what's important to understand: as long as you don't withdraw, you have an active case. Withdrawing ends your appeal immediately and your assessment stays exactly as it was—no reduction. But keeping your case alive means you're still in the queue for a potential reduction.

The Success Formula: Settlements, Not Battles

Among the 618 cases that reached a final decision, here's the stunning reality:

- 97.6% were resolved through settlement (stipulation)

- Only 6 cases (1%) went to formal hearing

Let that sink in. This is not an adversarial, courtroom-style process. It's a negotiation-based system where settlements are the norm, not the exception.

Here's how it works:

- Settlement (97.6% of cases): You and the county assessor negotiate and agree on a reduced assessed value before any hearing. Once you both accept the deal, it's done.

- Formal hearing (1% of cases): If you can't reach a settlement, your case goes before an independent Assessment Appeals Board. You're not arguing directly with the assessor—you're both presenting your case to an impartial board that makes the final decision.

To understand the different parties involved and their roles, see our guide on how the appeals board works.

What "Success" Actually Looks Like

Of the 618 decided cases:

- 176 cases (28.5%) achieved a reduction in their assessed value

- 1 case (0.2%) saw an increase (ouch, that's why it's important to support with data)

- 2 cases (0.3%) had no change

- The remaining cases had various outcomes

Among the 176 successful reductions:

- Median reduction: $170,400

- Median percentage reduction: 9.2%

- Average reduction: $246,412 (pulled up by some very large reductions)

In practical terms, if you own a $2 million home and successfully appeal, you're looking at roughly a 9% reduction, or around $180,000 in assessed value. With a typical property tax rate of 1.2% in San Mateo County, that translates to roughly $2,160 per year in tax savings until the next year.

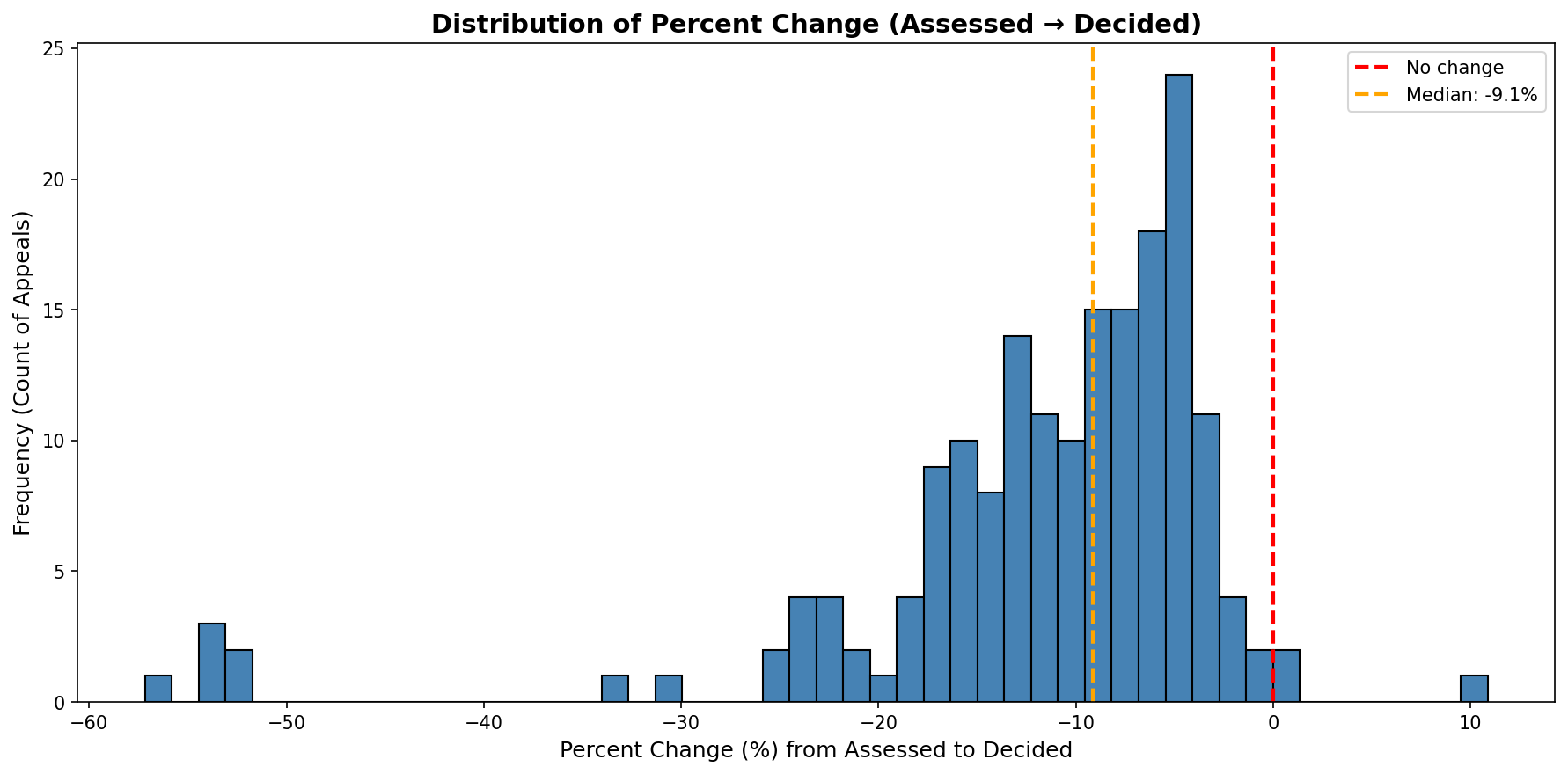

The reduction distribution is tightly clustered around the -9.2% median (orange line). Most successful appeals achieve 5-15% reductions, with a few outliers getting 50%+ reductions. The red line at 0% shows cases with no change.

The reduction distribution is tightly clustered around the -9.2% median (orange line). Most successful appeals achieve 5-15% reductions, with a few outliers getting 50%+ reductions. The red line at 0% shows cases with no change.

The Request vs. Reality Gap

Here's where it gets interesting. Among the 147 decided cases where property owners filed an opinion of value, the data shows:

- Median owner request: -13.1% reduction

- Median actual outcome: -9.2% reduction

- Success rate: 70% of requested reduction

Property owners are asking for a 13% cut and getting a 9% cut on average. That's a 3.9 percentage point gap, but it also means the system is responsive. The assessor's office is negotiating, not rejecting outright.

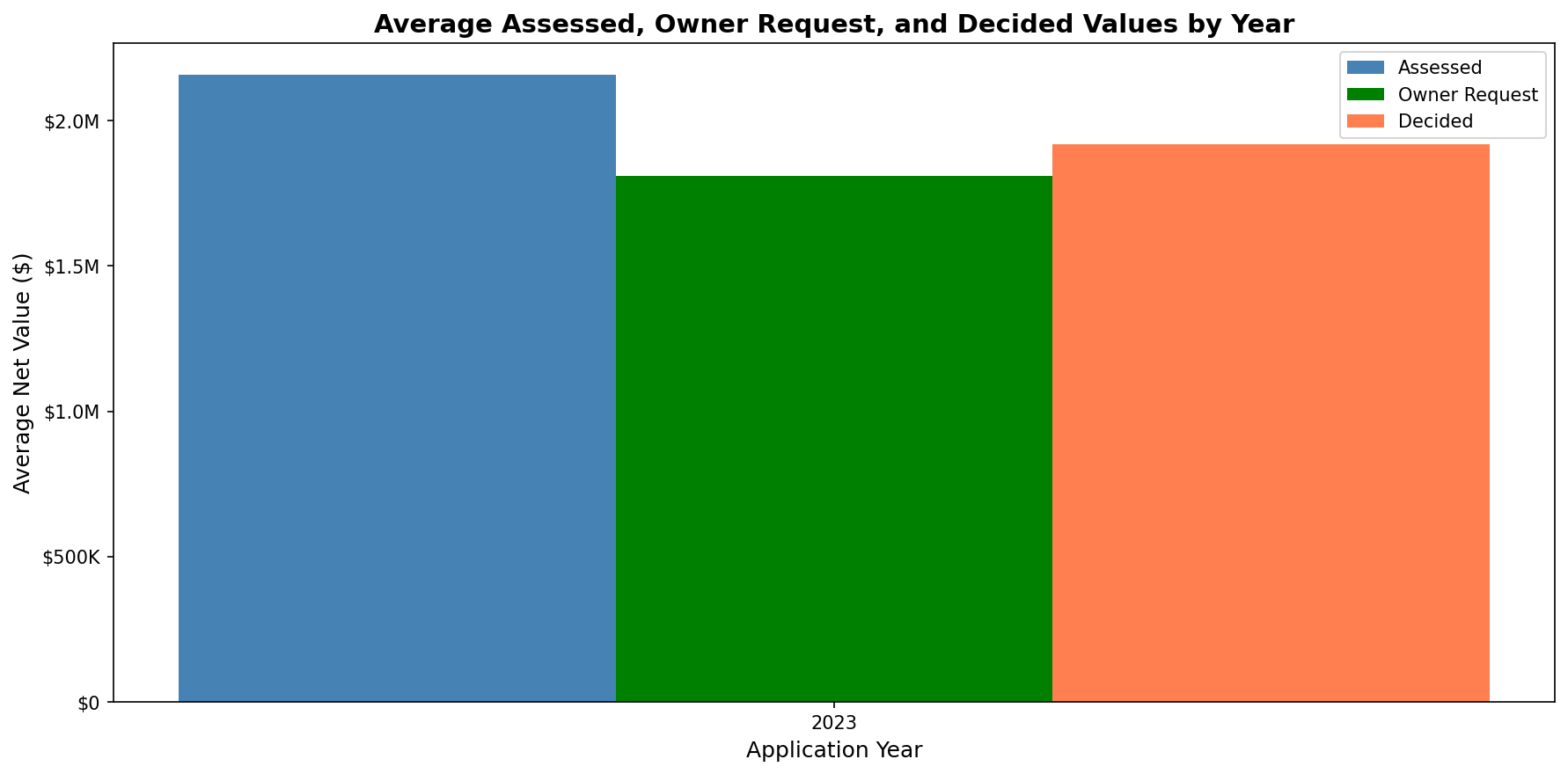

The visual proof of negotiation: Assessors start at $2.2M (blue), owners request $1.8M (green), and they settle at $1.9M (orange). The gap between owner request and final decision shows the system works through compromise, not all-or-nothing outcomes.

The visual proof of negotiation: Assessors start at $2.2M (blue), owners request $1.8M (green), and they settle at $1.9M (orange). The gap between owner request and final decision shows the system works through compromise, not all-or-nothing outcomes.

Part 2: The Zero-Effort Question — Is It Worth Just Mailing It In?

Now for the million-dollar question (or in San Mateo County, the $170,400 question): What happens if you put in minimal effort—just mail in the appeal form with basic evidence?

What the Data Tells Us About Effort

The analysis doesn't directly track "effort level," but we can infer valuable insights:

The Settlement Reality:

- Since 97.6% of decided cases settle without formal hearings, you don't need to prepare for courtroom-style litigation

- No need to hire expert witnesses, attorneys, or appraisers for trial

- The process is fundamentally collaborative, not adversarial

The Residential Advantage:

- 97.7% of decided cases were residential properties

- Commercial properties: 0% success rate (though only 14 cases, too small a sample)

The Evidence That Works Scenarios

While the dataset doesn't detail what evidence was submitted, we can infer from the settlement patterns what likely works:

Minimal Effort / High Impact: The highest chance for settlement is you provide clear comparable data that aligns with how the assessor and the appeals board look at sales comparables. (following the Califirnia Residencial Property Assessment Appeals Guide)

The settlement-based system means the assessor's office is evaluating reasonableness, not proof beyond a reasonable doubt. They're asking: "Is this claim plausible enough to warrant adjustment?"

If you provide:

- 3-4 comparable sales showing clearly lower values

- A clear, one-page letter explaining your position

You've given them enough to work with. They're not expecting a PhD dissertation.

The "Don't Bother" Scenarios

The data suggests you should skip the appeal if:

- Your property value has clearly increased - You risk the 0.2% outcome (an increase!)

- You're assessed well below market - Already getting a deal

- You can't find any supporting comps - No comparable sales suggesting lower value

- Recent purchase at current assessment - You need to own your home at least 1 year

The Bottom Line: Should You Appeal?

Based on 1,651 real cases from San Mateo County, here's the pragmatic advice:

✅ DO APPEAL IF:

- You have clear comparable sales showing lower values

- You can spend 2-4 hours gathering evidence

- Your assessment seems 10%+ too high

- Your home is worth $1M+ (bigger reduction potential)

⚠️ MAYBE APPEAL IF:

- Your evidence is marginal but you have time

- You're willing to withdraw if case looks weak

- You want to "test the waters" with the assessor

❌ DON'T APPEAL IF:

- You have no supporting evidence

- Your assessment is already favorable

- You recently purchased at the assessed value

- You can't spare even minimal time for documentation

The "Just Mail It In" Verdict

Yes, a minimal-effort appeal can absolutely work in San Mateo County. The settlement-based system, combined with the reasonable 70% fulfillment rate on requests, means the assessor's office is pragmatic.

However, "minimal effort" still means:

- Finding 3-5 comparable sales

- Taking photos if relevant

- Writing a clear, one-page letter with your valuation

- Filling out the appeal form correctly

- Submitting before the deadline

This is about 2-4 hours of work for a potential $170K+ reduction in assessed value.

That's not "zero effort," but it's also not hiring lawyers and appraisers. It's a DIY-friendly, settlement-oriented process where reasonable arguments backed by basic evidence can succeed.

The Math Works—For Everyone

With a ~13% probability of success and a median $170,400 reduction, the expected value is clearly positive for homeowners with assessments of $1M or more. Even accounting for time, effort, and opportunity cost, the risk-reward ratio favors attempting an appeal if you have legitimate comparable sales data.

But here's the key insight: That 13% accounts for everyone who files an appeal, including the 42% who withdraw. If you have strong evidence and stick with your case through to a value decision, the odds are overwhelmingly in your favor—among the 179 decided cases with value changes, 98.3% resulted in reductions (176 reductions, 1 increase, 2 no change). The difference between 13% and 98.3% is enormous: most people who withdrew likely didn't have strong evidence or their property sold. If you have solid comparable sales data and don't withdraw, you have a 98.3% chance of getting a reduction rather than an increase.

The question isn't "Should I appeal?" or even "Am I in the right situation to appeal?"

The question is simply: "Do I have 2-4 hours and comparable sales data showing lower values?"

For most San Mateo County homeowners with credible evidence, the answer is yes.

Appeal Without Effort!

Use our service AppealSeal to automate those 2-4 hours of work into seconds. We automatically find comparable sales, analyze your property assessment, generate your appeal documentation, and prepare everything for submission—all based on the same data patterns that lead to the 98.3% success rate. Submit your appeal without the research effort.

Data Sources & Methodology

This analysis is based on a public records request for all property tax appeals filed in San Mateo County during 2023, totaling 1,651 appeals (618 decided, 1,033 not decided).

Full Data & Methodology: All raw data, analysis code, and detailed methodology are available in our open-source GitHub repository: github.com/philippb/prop-tax-appeals-research

Questions or Feedback: If you have questions about the analysis or disagree with any conclusions, please open an issue on GitHub. We welcome constructive feedback and alternative interpretations of the data.

Disclaimer: Individual results will vary based on specific property circumstances, evidence quality, and market conditions. This blog post is for informational purposes and not legal or financial advice.